Use these links to rapidly review the document

Table of Contents

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment

(Amendment No. )

| | | |

Filed by the Registrantý ☒ | |

| | Filed by a Party other than the Registranto ☐ | |

| Check the appropriate box: | |

o |

☐ |

| | Preliminary Proxy Statement | |

o |

☐ |

| | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý |

☒ |

| | Definitive Proxy Statement | |

o |

☐ |

| | Definitive Additional Materials | |

o |

☐ |

| | Soliciting Material under §240.14a-12

| |

CF INDUSTRIES HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| | CF Industries Holdings, Inc.

(Name of Registrant as Specified In Its Charter) | | |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

| | | | |

Payment of Filing Fee (Check the appropriate box)all boxes that apply): | |

ý |

☒ |

| | No fee required.required | |

o |

☐ |

| | Fee paid previously with preliminary materials | |

| | ☐ | | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

0-11 |

|

1) |

|

Title of each class of securities to which transaction applies:

|

| | 2) | | Aggregate number of securities to which transaction applies:

|

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | 4) | | Proposed maximum aggregate value of transaction:

|

| | 5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1) |

|

Amount Previously Paid:

|

| | 2) | | Form, Schedule or Registration Statement No.:

|

| | 3) | | Filing Party:

|

| | 4) | | Date Filed:

|

20202022 Annual Meeting ofShareholders

4 Parkway NorthDeerfield, Illinois 60015

Table of Contentscfindustries.com

April 8, 2020

March 30, 2022

On behalf of your board of directors, it is our privilege to invite you to attend the

20202022 annual meeting of shareholders of CF Industries Holdings, Inc. The annual meeting will be held on Wednesday, May

20, 2020.11, 2022, in a virtual meeting format only, via the Internet. At the annual meeting, shareholders will vote on the matters set forth in the accompanying Notice of Annual Meeting

of Shareholders and Proxy Statement and any other business matters properly brought before the annual meeting.

Additionally, we will review our corporate performance in 2019 and discuss our strategy and our vision for the future. Whether or not you are able to attend the

annual meeting, we encourage you to read the enclosed materials and submit your proxy.

CF Industries’ 2021 Performance By almost every measure, 2021 was one of CF Industries’ most successful years ever. We leveraged our investments in operational excellence and capacity growth over the previous decade to capitalize on the opportunities that developed during the year, and generate strong returns. Throughout the year, we experienced strong global nitrogen demand, constrained nitrogen supply due to lower global industry operating rates, and favorable energy spreads that increased the margin opportunities for the company. These dynamics became much more pronounced in the second half of the year and, in particular, during the fourth quarter of 2021 when global nitrogen prices and energy spreads reached record highs.

For 2021, the company reported net earnings attributable to common stockholders of $917 million, or $4.24 per diluted share, and EBITDA Creating Long-Term Shareholder Value

(1) of approximately $2.2 billion. Net earnings and EBITDA reflect pre-tax non-cash impairment charges of $521 million related to our U.K. operations. Net cash from operations was approximately $2.9 billion and free cash flow(2) was approximately $2.2 billion, both company records. We want to recognize and thank the entire CF Industries team for their hard work and dedication in bringing about these impressive results, particularly given all of the challenges that 2021 presented.

Strong operational performance underpinned these financial results. We continue to operate safely with our full year recordable incident rate at 0.32 incidents per 200,000 work hours, significantly better than industry averages. This is especially impressive as we had our highest level ever of maintenance activities during the year, including seven ammonia plant turnarounds. This included two turnarounds deferred from the year before due to the COVID-19 pandemic, as well as one turnaround that was planned for 2022 but brought forward into 2021 to reduce the risk of an unplanned outage during the 2022 spring application season.

The company also navigated two severe weather events in North America (Winter Storm Uri and Hurricane Ida) that disrupted production across the industry. Our team’s ability to restart our plants safely and more quickly than our peers speaks to the skill of our people and the strength we have built into our manufacturing network.

We made the difficult but necessary decision to take our ammonia plants offline in the United Kingdom in September due to the excessively high cost of natural gas that made ammonia production unprofitable. We were able to restart one of the plants shortly thereafter supported by restructured CO2 supply contracts. CO2 is a natural byproduct of the ammonia production process, and it is used in a number of applications in the U.K. including food and beverage, nuclear power, and hospitals. We continue to evaluate the situation in the U.K. and are working through numerous scenarios to develop a longer-term solution there.

Our strong cash flow from operations in 2021 enabled us to make meaningful progress on several priorities for the company. We returned $800 million to shareholders through share repurchases and dividends, repaid $500 million in long-term debt, and increased the cash on our balance sheet by nearly $1 billion Our actions to strengthen our balance sheet have been recognized by upgrades to investment grade credit ratings from S&P Global Ratings and Fitch Ratings.

Governance of CF Industries

As we look ahead to the future, we remain committed to implementing sound corporate vision isgovernance practices that enhance the effectiveness of our board of directors and management team for the benefit of shareholders and our other stakeholders.

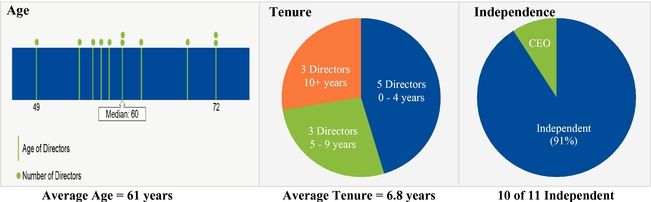

We believe the board’s structure and composition are integral to our ability to be effective for shareholders and other stakeholders and a leading chemicalvalued resource for management. Our director nominees consist of ten independent directors and the CEO. Our Chairman of the Board is independent and separate from the Chief Executive Officer.

The eleven director nominees represent a broad range of experience and skills. The Chairman of the Board and chair of the governance committee lead an active process to regularly assess Board performance, composition and attributes in succession planning and Board refresh. In 2021, we were fortunate to add two new independent directors as a result of this process: Deborah DeHaas, former vice chairman and managing partner of the Center for Board Effectiveness at Deloitte, and Jesus Madrazo, founder and chairman of Kompali Farms and former executive vice president, public affairs and sustainability of Bayer’s Crop Science division. Over half of the director nominees have joined the Board since 2017 and the director nominees as a group are 55% diverse (gender or racial/ethnic background).

Our committee structure provides a deep level of engagement with management and oversight of company activities. We work to continually identify areas of focus and emerging importance to stakeholders. For example, the board’s Compensation and Management Development Committee has oversight over inclusion, diversity and equity matters as well as employee well-being initiatives. Our Environmental Sustainability and Community Committee was created in 2020 to oversee the company’s clean energy initiatives, progress toward net-zero carbon emissions, community involvement efforts, and overall accountability for meeting the company’s environmental, social and governance (ESG) objectives. Finally, we align executive compensation not just to financial performance, but also on performance against ESG goals including employee safety and sustainability goals.

The Path Ahead

We believe that delivers superiorthe Board and management team working together will help create strong shareholder returns overvalue in both the cycle. In supportnear- and longer- term. We have a positive outlook on the near-term opportunities available to CF Industries and its shareholders due to strong global nitrogen industry fundamentals. We also remain focused on our long-term growth strategy, which is aligned with our commitment to have a positive impact on issues important to our many stakeholders.

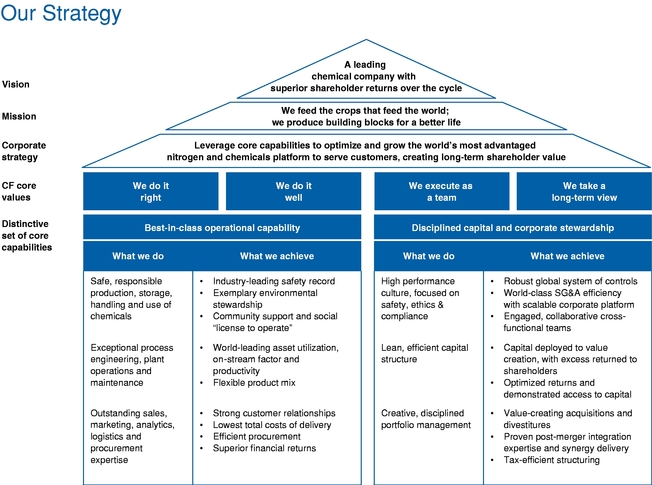

The production of our core product, ammonia, has helped transform the world’s ability to feed itself.

Although the ammonia production process is energy intensive, several other energy-intensive industries concerned about their carbon emissions have identified ammonia as a potential source of clean energy that vision, ourcould help them reduce their carbon footprints. This is due both to ammonia’s hydrogen component, which is widely viewed as a scalable source of clean energy, and to the fact that ammonia does not emit carbon when used as an energy source.

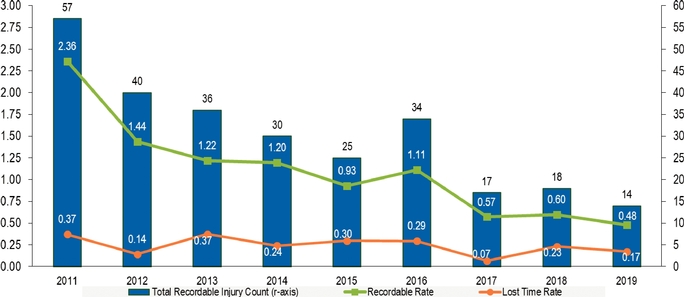

CF Industries’ strategy is to leverage our coreunique capabilities to drive business results that create long-term value for our shareholders. Ataccelerate the heart of our strategy is the CF team. During 2019, these 3,000 individuals set company records for quarterly sales volumes and ammonia production. Most importantly, we also set a new record for safety performance, achieving our lowest ever Recordable Injury Rate (RIR). This was accomplished against a backdrop of record flooding that greatly delayed the spring fertilizer application season and disrupted transportation networks in the United States.world’s transition to clean energy. We are extremely proudcommitted to decarbonizing our ammonia production network while collaborating with industry leaders to develop a global market for zero- and low-carbon ammonia as an energy source that can help other industries decarbonize their businesses as well.

In 2021, we made substantial progress on our clean energy initiatives. We started construction on North America’s first carbon-free green ammonia production capacity. We also announced two projects that, when complete, will reduce our CO2 emissions by up to 2.5 million tons annually, enabling the production of eachup to 1.25 million tons of our employeesnet-zero carbon ammonia — ammonia produced conventionally with the CO2 byproduct captured and their commitment and dedication to "Do It Right!" every day.Our dedication to operational excellence has driven strong financial results and significant free cash flow, with $1.5 billion of cash from operations and $915 million in free cash flow(1) generated in 2019 alone. We have taken a balanced approach to capital allocation, which has prudently positioned the company for the long-term. Since 2017, we have reduced our outstanding debt by $1.85 billion – including the redemption of $750 million in debt in 2019 – substantially reducing our annual fixed charges. Over that same period, we have also returned more than $1.6 billion to shareholders through share-repurchases and dividend payments. geologically sequestered.

We believe our strong balance sheet combinedclean energy initiatives go hand-in-hand with our superior cash generation provides substantial long-term capital flexibilitycomprehensive ESG goals. These include a dramatic reduction in carbon emissions across our global network with a commitment to achieve net-zero carbon emissions by 2050, with an intermediate goal of a 25% reduction in emissions intensity by 2030. In 2021, we added a new goal to reduce our Scope 3 greenhouse gas emissions, which we calculated and published for the first time, 10% by 2030. We also have set specific goals related to inclusion, diversity and equity, community involvement and nutrient stewardship.

In 2021, we exceeded our expectations on certain goals, such as identifying decarbonization projects, increasing representation of females and persons of color in senior leadership roles, and nutrient stewardship. We communicate our performance in these areas and other areas through our annual ESG and sustainability reporting, which are now available at https://sustainability.cfindustries.com. There, you can also access our submissions under the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) framework and the Task Force on Climate-related Financial Disclosures (TCFD).

CF Industries’ Future

As we entered 2022, global nitrogen industry fundamentals remained very favorable. The need to replenish global grains stocks and increased economic activity should continue to support robust global demand. High energy prices in Europe and Asia, as well as nitrogen export restrictions from key-producing countries such as China, Egypt, Russia and Turkey, are expected to challenge nitrogen supply availability. As a result, we believe CF Industries is well-positioned for the year ahead, despite the geopolitical tensions in the world and surging inflation as of this writing.

Our efforts have put CF Industries at the forefront of the emerging clean energy economy and the opportunities that we expect to develop for decarbonized ammonia. We believe this will underpin our ability to create shareholder value over the long-term.

Finally, we want to recognize the many contributions of Stephen A. Furbacher, who is retiring from the board of directors this year. Steve has been a member of the Board since 2007 and was chairman from 2014 through the

cycle.The CF team executedend of 2021. His commitment, dedication and insight were critical in these years as the company navigated rapid growth followed by challenging industry conditions and development into an industry leader. Steve leaves behind many legacies: helping to shape and develop our industry-leading safety culture; evolving our strategy extremelyto become a leading clean energy company, and helping us to define our role within our communities as larger than just an employer. However, his greatest impact from his time leading the Board may well be the Board itself. Steve has been a tireless advocate for transforming the Board by broadening our collective skills, experiences and it shows in our results. Since 2017,diversity. This purposeful effort will continue to serve the company and shareholders for years to come. We are grateful for the time we have worked with Steve and for his patient guidance and uncompromising standards, and we wish him all the best in his retirement.

Thank you for your continued trust in CF Industries. We look forward to discussing our performance and the opportunities ahead when we gather virtually for our annual meeting on May 11, 2022.

Sincerely,

| | | | | | |

| | Stephen J. Hagge

Chairman of the Board of Directors | | | W. Anthony Will

President and Chief Executive Officer | |

(1)

EBITDA is defined as net earnings attributable to common stockholders plus interest expense — net, income taxes, and depreciation and amortization. See Appendix A for a

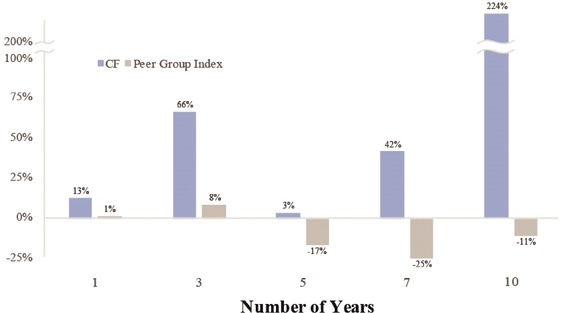

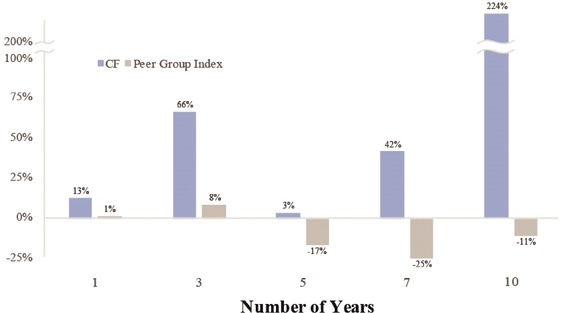

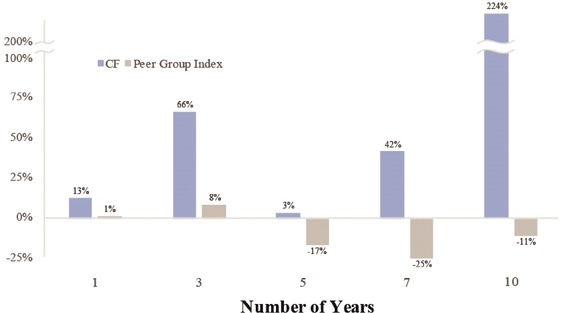

Total Shareholder Return (TSR)reconciliation of

66 percent, significantly better than our fertilizer peer group index and also better thanEBITDA to the

S&P 500. Our company TSR is also substantially better than our fertilizer peer group index over all relevant time periods: 1, 3, 5, 7 and 10 years. Our strategy, executed well, has clearly delivered against our vision: superior shareholder returns over the cycle.

(1)- most directly comparable GAAP measure.

(2)

Free cash flow is defined as net cash from operating activities less capital expenditures and distributions to noncontrolling

interests.interest. See Appendix A for a reconciliation of free cash flow to the most directly comparable GAAP measure.

Table of Contents

Increased Focus on Environmental, Social and Governance Issues

We recognize that continuing to build on our strong track record of creating long-term shareholder value requires enhanced focus not only on our operational excellence and corporate stewardship, but also on our longstanding commitment to a sustainable world. As a member of the Business Roundtable and a signatory to the Statement on the Purpose of a Corporation issued by that organization, we take our commitments and obligations to our broader stakeholders very seriously.

•We are good corporate citizens, specifically contributing to 11 of the UN Sustainable Development Goals. We have also made significant investments in our assets to improve energy efficiency and reduce GHG emission intensity. In 2020, we will be setting specific sustainability goals that we will track and report progress against in subsequent periods. We invite you to learn more about the positive impact we have on global sustainability athttps://www.cfindustries.com/sustainability-at-cf-industries.

•We are proud of the critical role we play in helping to feed the world, responsibly, ethically, and sustainably. Fertilizer is responsible for helping to grow about half of the global food supply which means it is critical to sustaining life for billions of people. It is also critical to the sustainability of the planet because fertilizer increases yield per acre, which means less acres are required to feed the world's population, preserving carbon-sequestering forests.

•We are good neighbors, and give back in the over 30 local communities where we have operations, by: providing educational assistance and scholarship funds; enhancing safety through training and donations of equipment to first responders; and through support and donations to local United Way and Red Cross programs. For more information about our charitable giving, see:https://www.cfindustries.com/reports.

•We care deeply about the wellbeing of our employees who together make these significant accomplishments possible through their dedication and efforts. We provide our employees competitive pay with full benefits, along with challenging and rewarding career opportunities within a safe operating environment. Our pay and benefits practices are evidenced by our company having a CEO Pay Ratio of 73:1, in the lowest 10% of the S&P 500. Our safety record (RIR: 0.48) is significantly better than the US Chemical Industry and the global fertilizer industry. We offer our employees an engaging, interactive well-being program that is focused on the 'whole person' and personalized based on each participant's own interests and goals. We strive to be the employer of choice in each of the communities in which we operate.

We believe transparency is critical as we seek to maximize the benefits of fertilizer while minimizing its impact on the environment in the years ahead. For the first time, we are publishing our sustainability report at the same time as our financial reports, reflecting our internal emphasis on both dimensions. Our sustainability reporting includes our Global Reporting Initiative (GRI) report, in which we report on a comprehensive basis and cover nearly all GRI indicators for each issue. Additionally, we will begin reporting using the Sustainability Accounting Standards Board (SASB) framework for the chemicals industry this year.

A Strong Future Ahead

As we write this, the spread of coronavirus disease 2019 (COVID-19) has been declared a pandemic by the World Health Organization and is severely affecting economies around the world. CF's focus has been protecting the health and well-being of our employees and everyone whose lives we touch.

Agriculture and fertilizer production are key parts of the food supply chain and, in response to the COVID-19 pandemic, have been designated as "essential," and a part of the U.S.

Table of Contents

"critical infrastructure," with a similar designation in the UK. This is for a very simple reason: in times of crisis, availability of food becomes of paramount importance. We serve a vital role in the process that provides food to people and helps to keep peace and order in our society. By protecting our people, we are doing our best to mitigate its impact on our operations and ensure that our vital contribution to feeding the world continues.

Finally, we want to recognize John Johnson, who is retiring from the board of directors this year. For the last 20 years, John has brought tremendous leadership, unparalleled insight and a steady voice to the board. He played a critical role in building the company we are today and shepherded CF into the modern era as the last chairman of the board before CF became a publicly traded company in 2005. We are grateful for his service and commitment to the company and our shareholders and wish him all the best in his retirement.

CF Industries is a strong company and positioned well for the future. We look forward to reviewing what we have achieved and the opportunities ahead at the annual meeting. Thank you for your continued trust in CF Industries and we hope to see you on May 20, 2020.

Sincerely,

| | |

4 Parkway North

Deerfield, Illinois 60015

Tel: 847.405.2400

cfindustries.com | |  |

Stephen A. Furbacher |

|

W. Anthony Will |

Chairman of the Board | | President and Chief Executive Officer |

Table of Contents

NOTICE OF ANNUAL MEETING OF

SHAREHOLDERS

| | | | | |

| Date and Time: | | | Wednesday, May 20, 2020,11, 2022, at 10:00 a.m., localCentral time | |

| Virtual Meeting: | | | Place:To support the health and well-being of our shareholders and other meeting participants, the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) will be conducted virtually at www.virtualshareholdermeeting.com/CF2022 |

|

Marriott Suites Deerfield

2 Parkway North

Deerfield, Illinois 60015 |

| Items of Business: |

|

| At the Annual Meeting, shareholders will be asked to: | |

| | | 1. | | Elect1.

elect the eleven directors named in thisthe accompanying Proxy Statement; | |

| | | 2. | | Consider2.

consider and approve an advisory resolution regarding the compensation of our named executive officers; | |

| | | 3. | | Ratify3.

approve our new 2022 Equity and Incentive Plan; | |

| | | | | 4.

ratify the selection of KPMG LLP as our independent registered public accounting firm for 2020;2022; | |

| | | 4. | | Act5.

act upon one shareholder proposal regarding the rightownership threshold required to act by written consent,call a special meeting of shareholders, if properly presented at the Annual Meeting; and | |

| | | 5. | | Consider6.

consider any other business properly brought before the Annual Meeting. | |

| Record Date: |

|

| You may vote at the Annual Meeting if you were a shareholder of record of our company as of the close of business on March 27, 202018, 2022. | |

| | Meeting Details: | | | Procedures for attending and participating in the virtual meeting and other information regarding the Annual Meeting can be found on

page 107. During the Annual Meeting, the list of our shareholders of record will be available for viewing by shareholders at www.virtualshareholdermeeting.com/CF2022. To view the list of shareholders, you will be required to enter the 16-digit control number on your Notice of Internet Availability of Proxy Materials or your proxy card. |

|

| |

Internet Availability of Proxy Materials: | | | Important Notice Regarding the Availability of Proxy Materials for the 20202022 Annual Meeting of Shareholders to be held on Wednesday, May 20, 202011, 2022: Our Proxy Statement and 20192021 Annual Report are available free of charge atwww.proxyvote.com. | |

We intend to hold our Annual Meeting in person. However, we are actively monitoring the coronavirus (COVID-19) situation. We are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements in advance of the Annual Meeting, and details on how to participate will be issued by press release available on our website at https://www.cfindustries.com and filed with the Securities and Exchange Commission.

Your vote is important.important. Please vote your shares promptly so that your shares will be represented whether or not you attend the Annual Meeting. To vote your shares, you may use the Internet as described on your Notice of Internet Availability of Proxy Materials and proxy card, call the toll-free telephone number listed on your proxy card or complete, sign, date, and return your proxy card. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option.

By order of the board of directors,

Douglas C. Barnard

Senior Vice President, General Counsel, and Secretary

April 8, 2020

March 30, 2022

Table of Contents

| | | |

| | | | | 1 | | |

| | PROPOSAL 1: ELECTION OF DIRECTORS | | | | | 12 10

| | |

| | | | | | | 1012 | | |

| | Director Succession Planning and Nomination Process | | | | | 1012 | | |

| | Criteria for Board Membership | | | | | 1314 | | |

| | | | | | | 16 | | |

| | Director Nominee Biographies | | | | | 17 | | |

| | | | | | | 23 23

| | |

| | Corporate Governance Guidelines | | | | | 23 | | |

| | | | | | | 23 | | |

| | | | | | | 23 | | |

| | | | | | | 2524 | | |

| | Attendance of Directors at Meetings | | | | | 26 | | |

| | Board Oversight of Strategy and Risk Management | | | | | 26 | | |

| | | | | | | 27 | | |

| | | | | | | 2830 | | |

| | | | | | | 30 Shareholder Engagement

| | 29 |

| | | | | | | 32 | | |

| | | | | | | 33 | | |

| | | | | | | 2933 | | |

| | | | | | | 34 Corporate Responsibility and Sustainability

| | 29 |

Director Compensation

| | |

COMMON STOCK OWNERSHIP | | | | | 36 34

| | |

| | Common Stock Ownership of Certain Beneficial Owners | | | | | 3436 | | |

| | Common Stock Ownership of Directors and

Management | | | | | 3638 | | |

| | POLICY REGARDING RELATED PERSON TRANSACTIONS | | | | | 39 37

| | |

| | PROPOSAL 2: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS ("(“SAY ON PAY"PAY”) | | | | | 41 39

|

| | |

| | | | | | | 4042 | | |

| | COMPENSATION DISCUSSION AND ANALYSIS | | | | | 44 | | |

| | | | | | | 4276 | | |

| | | | | | | 77 COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE REPORT

| | 78

|

| | | | | | | 92 EXECUTIVE COMPENSATION

| | 79

|

| | | | | | | 100 | | |

| | | | | | | 101 96

| | |

| | | | | | | 96101 | | |

| | | | | | | 96101 | | |

| | Pre-Approval of Audit and Non-Audit Services | | | | | 97102 | | |

| | | | | | | 97102 | | |

| | | | | | | 103 99

| | |

| | PROPOSAL 4:5: SHAREHOLDER PROPOSAL REGARDING THE RIGHTOWNERSHIP THRESHOLD REQUIRED TO ACT BY WRITTEN CONSENT CALL A SPECIAL MEETING OF SHAREHOLDERS | | | | | 104 100

| | |

| | The Board'sBoard’s Statement in Opposition | | | | | 101105 | | |

| | ANNUAL MEETING INFORMATION | | | | | 107 103

| | |

| | Questions and Answers about the Annual Meeting and Voting | | | | | 103107 | | |

| | Important Additional Information | | | | | 107111 | | |

| | Deadlines for Submission of Future Shareholder Proposals, Shareholder Nominated Director Candidates and Other Business of Shareholders | | | | | 107111 | | |

| | | | | | | 113 108

| | |

| | APPENDIX A: NON-GAAP RECONCILIATION DISCLOSURE ITEMS | | | | | A-1 | | |

| | | | | | | A-1B-1 | | |

This summary provides certain key information about CF

Industries'Industries’ business and strategy and highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire

proxy statementProxy Statement carefully before voting.

TheseThis Proxy Statement and a form of proxy

materials were first sent or made available to shareholders on or about

April 8, 2020.March 30, 2022.

20202022 ANNUAL MEETING OF SHAREHOLDERS INFORMATION

Wednesday, May 11, 2022, at 10:00 a.m. Central time

Location:

www.virtualshareholdermeeting.com/CF2022

Record Date:

March 18, 2022

VOTING MATTERS

Shareholders will be asked to vote on the following matters at the Annual Meeting:

| Proposals | | | Board

Recommendation | | | Page

Reference | |

Date1.

Election of Directors

The Board believes the director nominees provide us with the combined depth and Time:breadth of skills, experience and qualities required to contribute to an effective and well-functioning Board. | | Wednesday, May 20, 2020, at 10:00 a.m. (local time) | | | | Vote FOR each director nominee | | | 12 | |

Place:2.

Advisory Vote on Compensation of Named Executive Officers (“Say on Pay”)

CF Industries seeks a non-binding advisory vote from its shareholders to approve the compensation of the named executive officers as disclosed in this Proxy Statement. The Board values the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers. | | Marriott Suites Deerfield

2 Parkway North

Deerfield, Illinois 60015 | | | | Vote FOR | | | 41 | |

Record Date:3.

Approval of Our New 2022 Equity and Incentive Plan

The Board believes that our new 2022 Equity and Incentive Plan will enable CF Industries to continue to recruit, incentivize and retain qualified employees and non-employee directors and further align the interests of employees, directors and shareholders through stock-based compensation awards. | | March 27, 2020 | | | | Vote FOR | | | 92 | |

4.

Ratification of Selection of Independent Registered Public Accounting Firm for 2022

The audit committee has selected KPMG LLP to serve as CF Industries’ independent registered public accounting firm for 2022, and this selection is being submitted to our shareholders for ratification. The audit committee and the Board believe that the continued retention of KPMG to serve as CF Industries’ independent registered public accounting firm is in the best interests of the company and its shareholders. | | | | | | Vote FOR | | | 101 | |

5.

Shareholder Proposal Regarding the Ownership Threshold Required to Call a Special Meeting of Shareholders, if Properly Presented at the Annual Meeting

The Board believes that the action requested by the proponent is unnecessary and not in the best interests of the company and its shareholders. | | | | | | Vote AGAINST | | | 104 | |

We intend

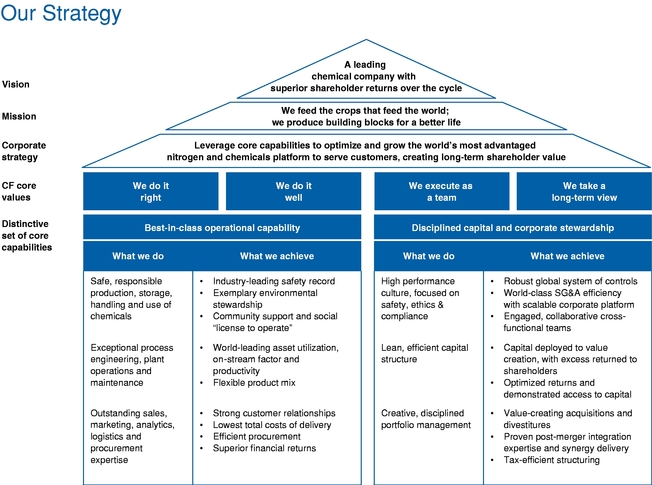

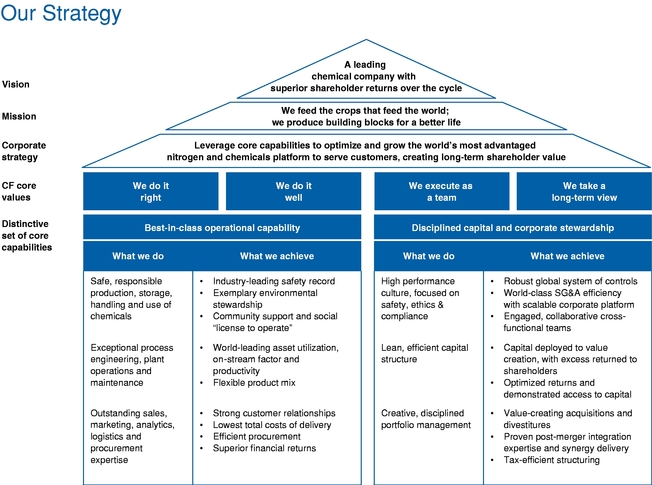

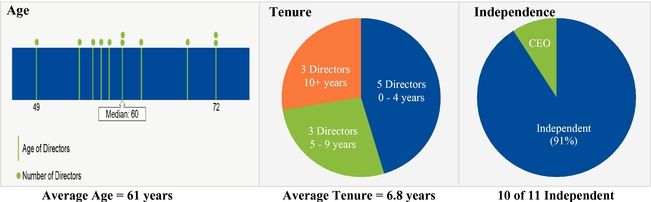

OUR BUSINESS AND STRATEGY

At CF Industries, our mission is to

holdprovide clean energy to feed and fuel the world sustainably. With our

Annual Meeting in person. However,employees focused on safe and reliable operations, environmental stewardship, and disciplined capital and corporate management, we are

actively monitoringon a path to decarbonize our ammonia production network — the

coronavirus (COVID-19) situation. We are sensitiveworld’s largest — to

the public healthenable green and

travel concerns our shareholders may haveblue hydrogen and

the protocols that federal, state,nitrogen products for energy, fertilizer, emissions abatement and

local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements in advance of the Annual Meeting, and details on how to participate will be issued by press release available on our website at https://www.cfindustries.com and filed with the Securities and Exchange Commission. VOTING MATTERS

| | | | | | |

| Proposals | | Board

Recommendation | | Page

Number for

Additional

Information |

| 1. | | Election of Directors | | FOR | | 10 |

| 2. | | Advisory Vote on Executive Compensation ("Say on Pay") | | FOR | | 39 |

| 3. | | Ratification of Selection of Independent Auditor for 2020 | | FOR | | 96 |

| 4. | | Shareholder Proposal Regarding the Right to Act by Written Consent, if properly presented at the Annual Meeting | | AGAINST | | 100 |

OUR BUSINESS

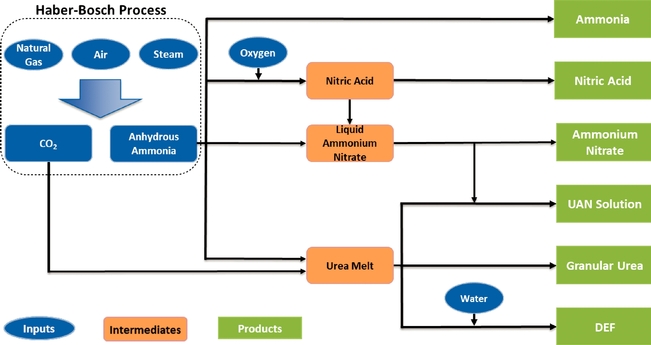

CF Industries is a leading global fertilizer and chemical company with outstanding operational capabilities and a cost-advantaged production and distribution platform.other industrial activities. Our 3,000 employees operate world-classnine manufacturing complexes in the United States, Canada, and the United Kingdom, and the United States. Our customers include both agricultural and industrial users of our products. Our principal nitrogen products are ammonia, granular urea, urea ammonium nitrate solution, and ammonium nitrate. We also manufacture diesel exhaust fluid, urea liquor, nitric acid, and aqua ammonia, which are sold primarily to industrial customers, and compound fertilizer products, which are solid granular fertilizer products for which the nutrient content is a combination of nitrogen, phosphorus, and potassium. We serve our customers in North America through an unparalleled production, storage, transportation and distribution network. We also reachnetwork in North America, and logistics capabilities enabling a global customer base with exports fromreach underpin our Donaldsonville, Louisiana, plant,strategy to leverage our unique capabilities to accelerate the world's largestworld’s transition to clean energy. Our best-in-class operational capability and most flexible nitrogen complex. Additionally,disciplined capital and corporate stewardship — supported by a culture rooted in our core values that we move product to international destinations fromlive each and every day — drive business results that create long-term value for all our Verdigris, Oklahoma, facility,stakeholders. Our strategy is reviewed and endorsed annually by the Board, and the Board plays an active role in overseeing the successful execution of our Yazoo City, Mississippi, facility, our Billingham and Ince facilities in the United Kingdom, and a joint venture ammonia facility in the Republic of Trinidad and Tobago in which we own a 50 percent interest.

strategy.

For more information on our business, see "Item“Item 1. — Business"Business” and "Item“Item 7. — Management'sManagement’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” in our 20192021 Annual Report.

Our Commitment to a Clean Energy Economy

We are taking significant steps to support a global hydrogen and clean fuel economy, through the production of green and blue ammonia. Since ammonia is one of the most efficient ways to transport and store hydrogen and is also a fuel in its own right, we believe that CF Industries, as the world’s largest producer of ammonia with an unparalleled manufacturing and distribution network and deep technical expertise, is uniquely positioned to fulfill anticipated demand for hydrogen and ammonia from green and blue sources. Our approach includes green ammonia production, which refers to ammonia produced through a carbon-free process, and blue ammonia production, which relates to ammonia produced by conventional processes but with CO2 removed through carbon capture and sequestration (CCS) and other certified carbon abatement projects.

We have announced a $100 million green ammonia project at our flagship Donaldsonville complex to produce approximately 20,000 tons per year of green ammonia. Construction and installation

began in the fourth quarter of

Contents2021 and is expected to finish in 2023. We believe that, when completed, the Donaldsonville green ammonia project will be the largest of its kind in North America.

We have also announced steps to produce blue ammonia from our ammonia production network. In the fourth quarter of 2021, the Board authorized $285 million in capital projects that will enable the annual production of up to 1.25 million tons of blue ammonia from our existing network starting in 2024. The projects will involve constructing units at our Donaldsonville and Yazoo City complexes that dehydrate and compress CO OUR STRATEGY

2Our vision, given, a process essential for CO2 transport via pipeline to sequestration sites. Management expects that, once the cyclical natureunits are in service and sequestration is initiated, we could sequester up to 2.5 million tons of CO2 per year.

We believe that execution of our

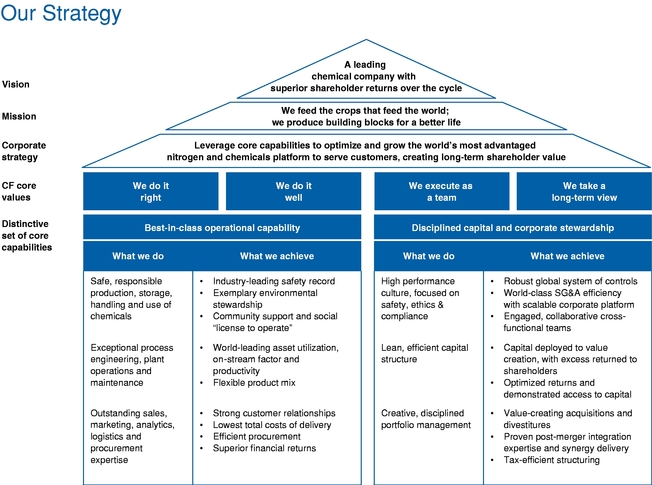

business, is to deliver superior shareholder returns overstrategy and development of the

cycle. Our strategy, in support of our vision, is built upon a foundation of distinct core capabilitiesmarket for green and

core values that we live eachblue ammonia will provide significant growth opportunities and

every day. We leverage our capabilities to drive business results that creategenerate sustainable long-term value for

our shareholders. Our strategy is reviewed and endorsed annually by our Board and the Board plays an active role in measuring our ability to execute it successfully.

Our Strategy Is Aligned with Our Mission and Corporate Responsibility

Our strategy for creating long-term shareholder value is directly aligned with our mission: We feed the crops that feed the world and produce the building blocks for a better life, and we do so efficiently, safely, and sustainably. Fertilizer is responsible for helping to grow the crops that comprise about half of the world's food supply, which makes life possible for billions of people. Fertilizer also supports sustainable food production because it increases yield per acre, which means farmers need less land to grow the food the world's population needs to survive. By increasing crop yields, we help limit the conversion of carbon-sequestering forests into farmland. We also manufacture products that reduce greenhouse gas emissions from industrial processes. In addition, our diesel exhaust fluid product helps reduce nitrous oxide emissions of heavy-duty trucks and marine vessels. For further discussionall of our corporate responsibilitystakeholders.

Shareholder Returns

The global nitrogen industry is inherently cyclical, and

sustainability practices, see "Corporate Governance — Corporate Responsibilityour financial results can be significantly impacted by the pronounced effects of highly volatile commodity prices for our products as well as for natural gas, which is our principal feedstock. Additionally, we execute our strategy and

Sustainability."Manufacturing chemical products responsibly requiresevaluate our performance over a focus on safety. At CF Industries, safety is more than just a requirement — it is a point of pride and ingrained in our corporate culture and values. This commitment is illustrated byfull cycle for our industry, leading safety statistics. At CF Industries,which typically occurs over multiple years. As a result, we believe that our strong safety record is a result of our focus on behavioral safety practices. During 2018 and 2019, we further demonstrated our commitment to

Table of Contents

operational excellence and safety by incorporating an operational metric into our annual incentive plan which was based on our achievement of ammonia production goals, subject to first achieving a gating level of performance on behavioral safety practices. See "Compensation Discussion and Analysis" for further information.

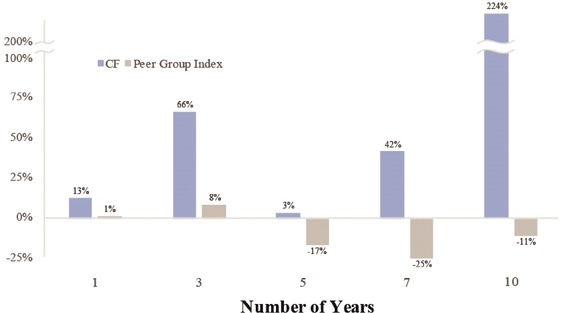

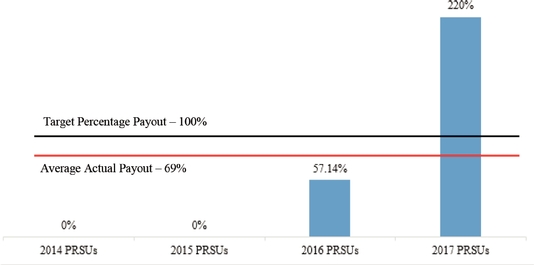

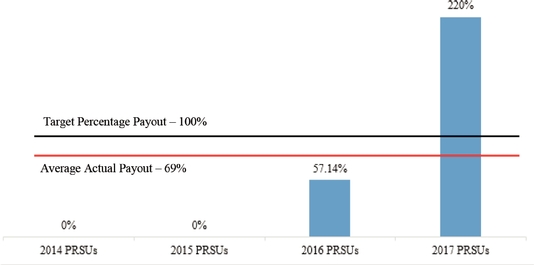

Strong Shareholder Returns Over the Cycle

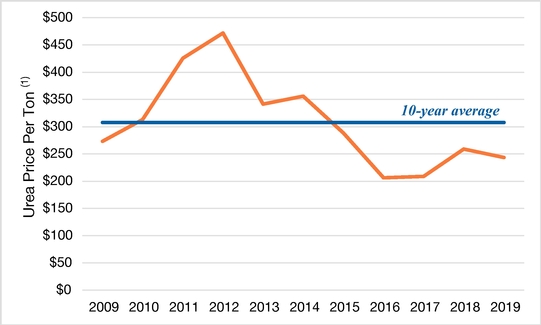

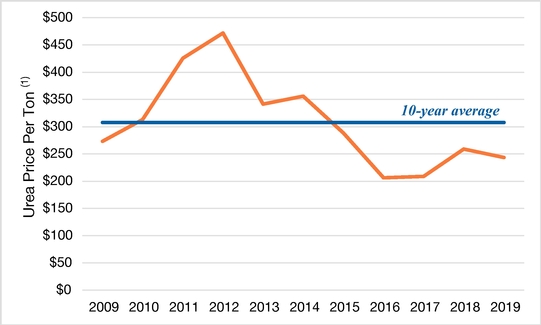

We firmly believe that, due to the cyclical nature of the commodity chemical industry in which we operate, it is important to view performancetotal shareholder return over a longer time horizon than just one year. Our execution of initiatives aligned with our strategy helped us achieve our vision — delivering superior shareholder returns over the cycle. The following table shows the cumulative total shareholder return (“TSR”), assuming the reinvestment of dividends, for our common stock and a peer group index for the 1, 3, 5, 7,1-, 3-, 5-, 7-, and 10-year periods ended December 31, 2019.

Total Shareholder Return (TSR)

2021.

![[MISSING IMAGE: tm223611d1-bc_shareholderpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-040102/tm223611d1-bc_shareholderpn.jpg)

Each of the peer group companies

is or was a publicly traded manufacturer of agricultural chemical fertilizers. The companies comprising the peer group are:

| | | | | |

Agrium, Inc.* | | | The Mosaic Company | | | LSB Industries, Inc. | |

| Incitec Pivot Limited | | | OCI N.V.** | | | Potash Corporation of Saskatchewan Inc.* | |

| Nutrien Ltd.* | | | CVR Partners LP**LP | | | Yara International ASA | |

Agrium, Inc. (Agrium)(“Agrium”) and Potash Corporation of Saskatchewan Inc. (Potash Corp)(“Potash Corp”) are included in the peer group companies from December 31, 20092011 through December 31, 2017. On January 2, 2018, Agrium and Potash Corp completed a merger of equals transaction to form Nutrien, Ltd. The cumulative investment in each of Agrium and Potash Corp, assuming

dividend reinvestments up to December 31, 2017, was converted into shares of Nutrien, Ltd. on January 2, 2018 using the exchange ratio in the merger of equals transaction consummated on that date. Nutrien, Ltd. wasis included in the peer group companies for the period from January 2, 2018 through December 31, 2019.

2021.**CVR Partners LP and

OCI N.V. werehas been excluded from the calculation of the 10-year total shareholder return because they eachits shares had less than 10-years10 years of trading history.history as of December 31, 2021.

For purposes of calculating the TSR of CF Industries and the peer group index for the 1, 3, 5, 7,1-, 3-, 5-, 7-, and 10-year10‑year periods ending December 31, 2019,2021, the beginning stock price for each peer group company was established by its respective closing price on the last trading day immediately preceding January 1 of the first fiscal year of the applicable measurement period. The returns of the peer group companies were weighted according to their respective market capitalizations as of the date used to establish the beginning stock price. For Yara International ASA, Incitec Pivot Limited and OCI N.V., we used their respective home exchange stock prices, converted into U.S. dollars, for TSR calculation purposes.

Table of Contents

20192021 PERFORMANCE HIGHLIGHTS

Operating Results | | | | | | | | | | | | | | | | |

| | | | | Net Earnings

Attributable to

Common Stockholders | | | | | | Earnings Per Diluted

Share | | | | | | |

| | Net Earnings

Attributable to

Common StockholdersEBITDA

| | | | Earnings Per

Diluted Share(1) | | | | EBITDA(1) | | | | Net Cash Provided by

Operating Activities | | |

| | | | | | | | | | Net Cash Provided by

Operating Activities | | |

| | | | | |

| |

$493917 Million

| | | |

$2.23

| | | |

$1.6 Billion

| | | |

$1.5 Billion

| | |

| | | | | | | | | | | | | | | | |

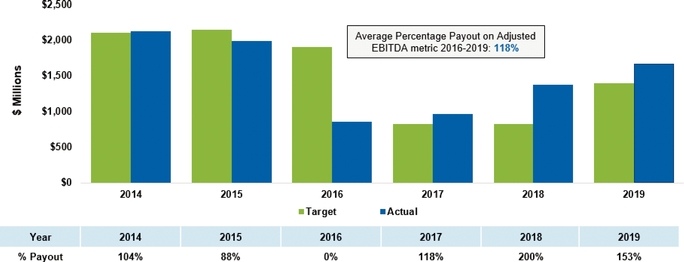

Annual Incentive Plan Performance Metrics

| | | | | | | | | | | | |

| | $4.24 | | | | | | $2.17 Billion | | | | $2.87 Billion

| | |

| | Adjusted EBITDA(2) | | | | Behavioral Safety

Gate Threshold | | | | Gross Ammonia

Production | | |

Annual Incentive Plan Performance Metrics

| | | Financial Metric | | | | | | | | | | |

| |

$1.6 Billion

| | | |

Achieved

98.7% | | | |

10.2 Million Tons

| | |

Environmental Metric | | | | Process Safety Metric | | |

| | | Adjusted EBITDA(2) | | | | List for Reduction of

GHG Emissions(3) | | |

| | Target: $1.4 Billion | | | | Threshold:Behavioral Safety

³Gate Threshold 95%(3)(4)

| | | | Target: 10.0 Million Tons | | |

| | | | Timely Completion

Percentage(5) | | |

| | | $2.74 Billion | | | | Achieved 54% | | | | Achieved 99% | | | | Achieved 99.6%

| | |

| | | Target: $1.35 Billion | | | | Target: 20% | | | | Threshold: ≥ 95% | | | | Target: 80% | | |

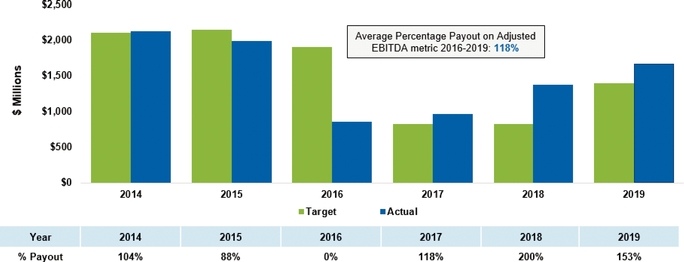

When setting performance levels for the short-term incentive program, the compensation and management development committee considers the previous year'syear’s financial performance, market trends and the company'scompany’s annual business plan. Going into 2021, rising energy costs in North America were projected to lead to higher realized natural gas costs for the company as energy feedstock prices rebounded from the lows of the global pandemic. The company also expected meaningfully lower production volumes in 2021, driven by a record number of planned maintenance activities due to the normal level of annual activity plus a significant number of maintenance activities that were deferred from 2020 to minimize the risk to our workforce of exposure to COVID-19. In addition, higher selling, general and administrative (“SG&A”) expenditures were anticipated for 2021 compared to 2020 as activities returned to pre-pandemic levels. These factors were expected to be partially offset by improved product prices across all products in 2021 compared to 2020, primarily driven by higher global energy prices and greater industrial demand.

Actual financial results in 20192021 greatly exceeded the company's plan as product prices improved more than anticipated — contributing tocompany’s forecasts, led by higher revenue from strong product pricing. Global nitrogen prices reached the highest levels in over a decade with a dramatic tightening of the global supply and margins. During 2019, we also exceeded ourdemand balance driven by high crop prices, increased economic activity and lower global production goals in part due to our best-in-class operational capabilities that enable ushigh energy prices in Europe and Asia. Despite higher gas and energy costs as compared to produce more product than other comparable manufacturers. At the same time,business plan, both in North America and, to a greater degree, in the United Kingdom, energy cost of our principal feedstock, natural gas,spreads between North

America and high-cost regions grew, resulting in greater margins for the company overall compared to plan. Sales volume for 2021 declined compared to

plan as our production levels were impacted by weather, including the

prior yearimpact of Winter Storm Uri in February and

much more than the market expectations reflectedHurricane Ida in

October, and we pulled forward

market curves when setting our annual business plan. This combination of a more advantageous pricing environment, lower natural gas cost, and efficient production contributed to the above-target financial results, and, therefore, an above-target payoutcertain maintenance activity originally scheduled for

the annual incentive program.2022.

Additionally, the company continued to deliver

againston its strategic priorities and create long-term shareholder value.

| | | | | | | | | |

Safety | | | | | | | | |

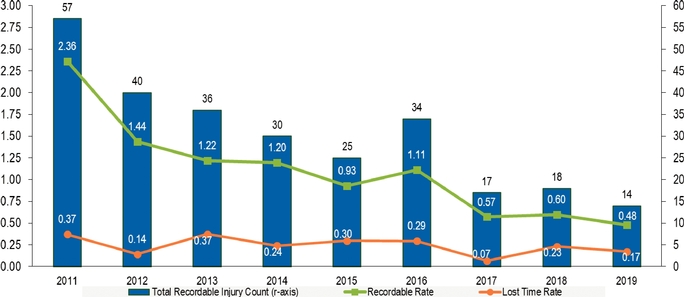

| | Safety | | | | As of December 31, 2019,2021, the company'scompany’s 12-month rolling average recordable incident rate was 0.480.32 incidents per 200,000 work hours – an industry leading result | | |

| | | Operational Excellence | | | | | | |

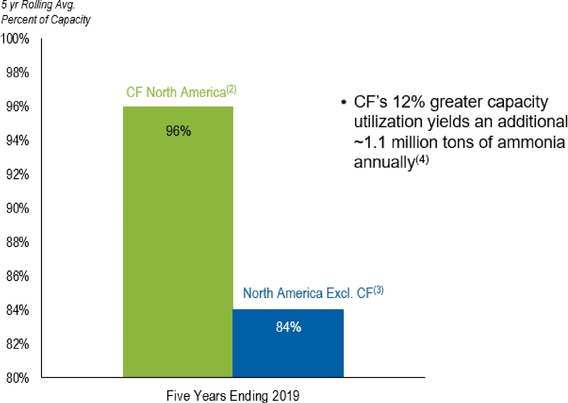

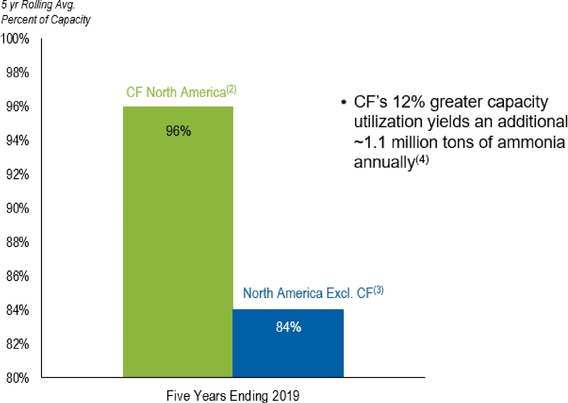

| | Operational Excellence | | | | Long-term asset utilization-and-productionutilization over the last five years is approximately 1214 percent higher than the average utilization rate of our North American competitors | | |

| | | Efficiency | | | | | | | | |

| | Efficiency | | | | SG&A costs as a percentpercentage of sales remainremained among the lowest in both the chemicals and fertilizer industries | | |

in 2021 | | |

| | | Return to Shareholders | | | | | | |

| | Return to Shareholders | | | | Returned $602$799 million to shareholders in 2021 through $337$541 million in share repurchases and $265$258 million in dividend payments | | |

payments. | | |

| | | | | | | |

| | Reduced Debt and Fixed Charges | | | | During 2019, we retired $750 million of outstanding indebtedness, reducing annual cash interest expense in 2020 by $44 million compared to 2019 | | |

| | Clean Energy Commitment | | | | We are taking significant steps to decarbonize our own production network and support a global hydrogen and clean fuel economy, through the production of green and blue ammonia | | |

| | | Comprehensive ESG Goals | | | | In line with our commitment to the clean energy economy and our focus on sustainability, we have published comprehensive environmental, social and governance ("ESG") goals covering critical environmental, societal, and workforce imperatives | | |

(1)

EBITDA is defined as net earnings attributable to common stockholders plus interest expense-net, income taxes and depreciation and amortization. See Appendix A for a reconciliation of EBITDA to the most directly comparable GAAP measure.

(2)

See

"Compensation“Compensation Discussion and Analysis

–— Compensation Discussion and Analysis: In Detail

–— Key Elements of NEO Compensation Program

–— Our Metrics

Defined"Defined” for the definition of Adjusted EBITDA for purposes of our annual incentive plan.

(3)

The Secondarydevelopment of a list of capital projects to reduce the company’s Scope 1 greenhouse gas (GHG) emissions footprint versus a 2019 baseline. The percentage target is the aggregate amount of the company’s GHG emissions that could be reduced through the implementation of the identified capital projects, as compared to the 2019 Scope 1 emissions baseline.

(4)

The Process Safety Metric Tons of Ammonia Produced, has a behavioral safety gate threshold. If at least 95% of the aggregated safety grades of all employees at manufacturing sites were a "B"“B” or better for the year, the safety performance gating requirement would be achieved. If the safety performance gating requirement was not achieved, there would be no payout under the SecondaryProcess Safety Metric.

(5)

TableThe completion of Contentsscheduled safety critical equipment inspections on schedule and timely management of changes (MOCs).

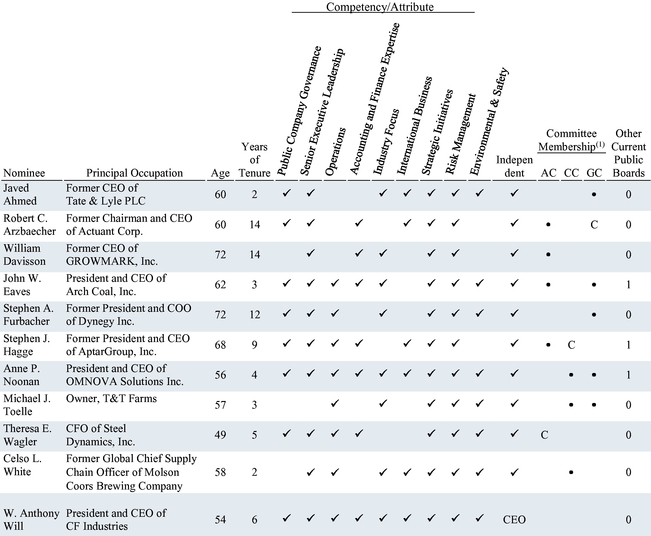

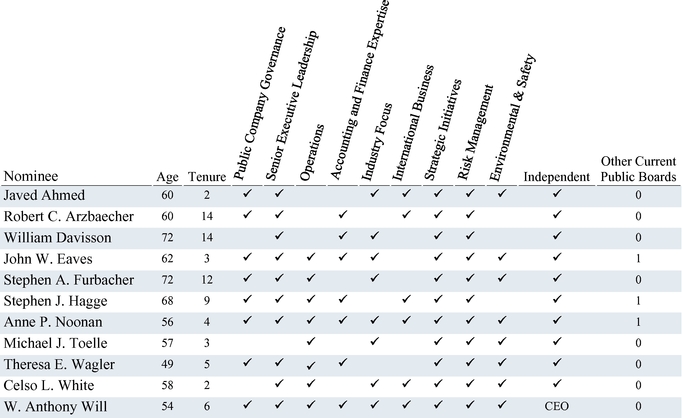

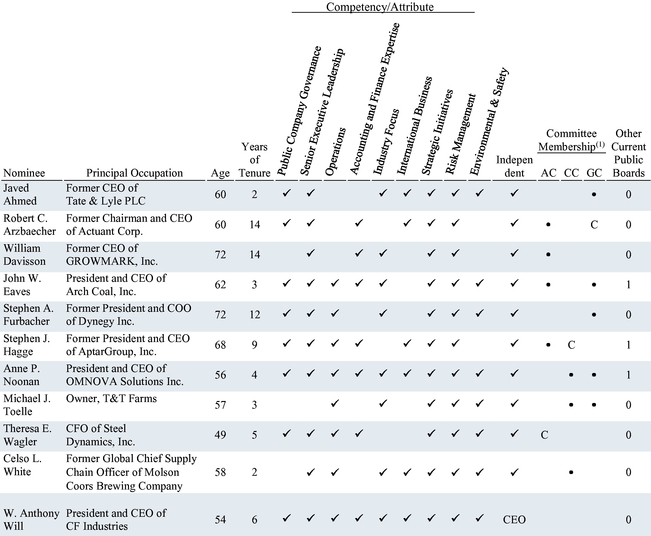

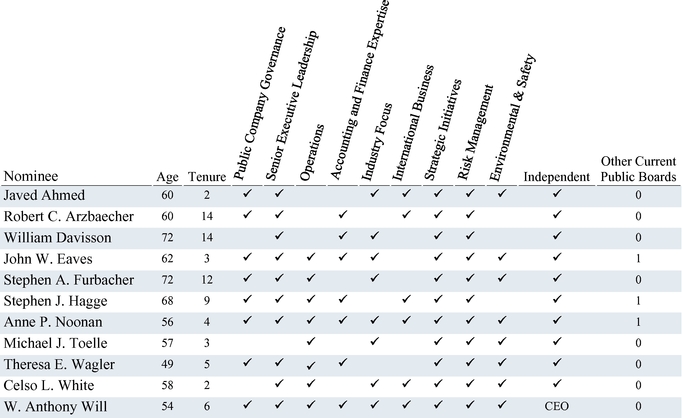

Our corporate governance and nominating committee regularly reviews the overall composition of

ourthe Board and its committees to assess whether each reflects the appropriate mix of experience, qualifications, attributes, and skills that are relevant to CF

Industries'Industries’ current and future global strategy, business, and governance.

(1)AC = Audit CommitteeCC = Compensation and Management Development Committee

GC = Corporate Governance and Nominating Committee

C = Committee Chair

Nominee

Primary Occupation | | | Age | | | Director

Since | | | Independent | | | Other

Public

Boards | | | Committee

Memberships(1) | |

| | AC | | | CC | | | GC | | | EC | |

Javed Ahmed

Former CEO of Tate & Lyle PLC | | | 62 | | | 2018 | | | Yes | | | 0 | | | | | | ● | | | ● | | | | |

Robert C. Arzbaecher

Former Chairman and CEO of Actuant Corporation | | | 62 | | | 2005 | | | Yes | | | 0 | | | ● | | | | | | | | | C | |

Deborah L. DeHaas

Former Vice Chairman and Managing Partner

Center for Board Effectiveness, Deloitte | | | 62 | | | 2021 | | | Yes | | | 1 | | | ● | | | | | | | | | ● | |

John W. Eaves

Executive Chairman of Arch Resources, Inc. | | | 64 | | | 2017 | | | Yes | | | 1 | | | ● | | | C | | | | | | ● | |

Stephen J. Hagge

Former President and CEO of AptarGroup, Inc. | | | 70 | | | 2010 | | | Yes | | | 1 | | | ● | | | ● | | | | | | | |

Jesus Madrazo

Former EVP, Public Affairs and Sustainability of

Bayer AG, Crop Science division | | | 52 | | | 2021 | | | Yes | | | 0 | | | | | | | | | ● | | | ● | |

Anne P. Noonan

President and CEO of Summit Materials, Inc. | | | 58 | | | 2015 | | | Yes | | | 1 | | | | | | ● | | | C | | | | |

Michael J. Toelle

Owner, T & T Farms | | | 59 | | | 2017 | | | Yes | | | 0 | | | | | | ● | | | | | | ● | |

Theresa E. Wagler

CFO and EVP of Steel Dynamics, Inc. | | | 51 | | | 2014 | | | Yes | | | 0 | | | C | | | | | | | | | ● | |

Celso L. White

Former Global Chief Supply Chain Officer of

Molson Coors Brewing Company | | | 60 | | | 2018 | | | Yes | | | 1 | | | | | | ● | | | ● | | | | |

W. Anthony Will

President and CEO of CF Industries | | | 56 | | | 2014 | | | CEO | | | 1 | | | | | | | | | | | | | |

| | (1) | | | AC | | | = Audit Committee | |

| | | | | CC | | | = Compensation and Management Development Committee | |

| | | | | EC | | | = Environmental Sustainability and Community Committee | |

| | | | | GC | | | = Corporate Governance and Nominating Committee | |

| | | | | C | | | = Committee Chair | |

We are committed to implementing sound corporate governance practices that enhance the effectiveness of the Board and our management and that serve the interests of our shareholders. Highlights of our governance practices include:

| | | | | | | | | | | | |

| | | | | | | | | Governance Practice | | | | |

| | | | | | Governance Practice

|

| | | For More Information |

| |

| | | | | | | | | | | | | |

| | Board Structure

and Governance

|

| | Board Structure

and Governance | | | | All of director nominees areindependent, except for our CEO.chief executive officer (“CEO”). All of our standing Board committees are 100 percent independent. We have anindependent Chairman of the Board and separate Chief Executive Officer.CEO. Our directors areelected annually based on amajority voting standard for uncontested elections. We have aresignation policy if a director failsfor incumbent directors who fail to receive a majority of votes cast. Each of ourdirectors attended 75% or more of the combined total meetings of the full Board and the committees on which he or she served during 2019.2021. Our non-managementnon-employee directors meet inexecutive session, without management present, followingduring each regularly scheduled Board meeting. AnnualBoard and committee self-assessments and peer evaluations monitor the performance and effectiveness of the Board and its committees and directors. The Chairman of the Board and chair of the governance committee lead an active process toregularly assess Board composition and attributes and consider succession planning. We considerdiversity of background, including experience and skills as well as personal characteristics such as race, gender and age, in identifying nominees for director and incorporate recruitment protocols in our candidate searches that seek to identify candidates with these diversity characteristics. The Board plays an active role inreviewing and approving our strategy, and in measuringoverseeing the successful execution of our ability to execute it successfully.strategy. DiligentBoard oversight of risk management, including climate change, is a cornerstone of the company'sour risk management program. The Board has an integral oversight role inhuman capital management oversight of sustainability and engages with senior management on a broad range of environmental, social, and governancetopics, including culture, talent development, compensation, employee recruiting and retention,climate change, human capital management and diversity and inclusion.inclusion, and our related | | | | P. 23-25

comprehensive ESG goalsP. 23-24

P. 10

P. 26

P. 24

P. 24

P. 10-12

P. 13

P. 26-27

P. 26-28

P. 27-28

| | |

| . | | | | | | | | | | P. 23-26 P. 23-24 P. 12 P. 26 P. 24 P. 24 P. 12-14 P. 14-15 P. 26-27 P. 26-27 P. 27-29;30-32 | | |

| | | |

| | Stock

Ownership | | | | We have strongstock ownership guidelines for our executive officers and directors. Weprohibit hedging and pledging of our common stock by directors and executive officers. We have a robustclawback policy covering incentive awards. | | | | P. 75-76P. 77

P. 76-77

| | |

| | | | | | | | P. 74 P. 75 P. 74 | | |

| | | Corporate

Responsibility | | | | |

| | |

| | | •

Ourethics program includes a strong Code of Corporate Conduct for all of our directors, officers and employees. We discussCorporate Responsibility on our website and in ourCorporate Sustainability Reportsustainability reports, including our values and "Do“Do It Right"Right” culture, our commitment to our stakeholders and communities, and our strong corporate commitment torespect the dignity and human rights of others. We providedisclosure of charitable contributions and corporate political contributions and trade associate dues in semi-annual reports. | | | | P. 29-30www.cfindustries.com/ sustainability-at-cf-industries

www.cfindustries.com/reports

| | |

| | | | | | | | P. 32 https://sustainability.

cfindustries.com www.cfindustries.com/reports | | |

| | | Shareholder

Rights | | | | |

| | |

| | | •

Eligible shareholders can utilize theproxy access provisions of our bylaws to include their own nominees for director in our proxy materials along with Board-nominated candidates. Wedo not have a shareholder rights plan, or poison pill. OurThe Board has adopted a policy whereby any shareholder rights plan adopted without shareholder approval must be submitted to shareholders for ratification, or the plan must expire, within one year of such adoption. Our shareholdersOne or more holders of our common stock representing at least 25% of the voting power of our common stock have theright to call a special meeting of shareholders. Allsupermajority voting provisions have been eliminated from our certificate of incorporation and our bylaws. | | | | P. 12; Bylaws

Bylaws

Charter and Bylaws

| | |

| | | | | | | | P. 14; Bylaws Bylaws Charter and Bylaws | | | | | | |

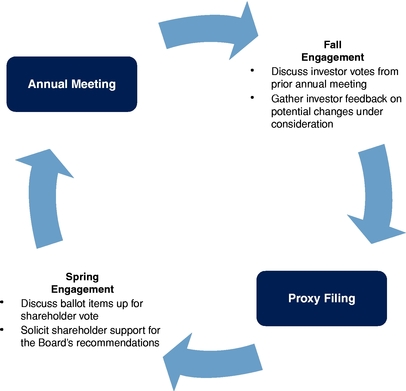

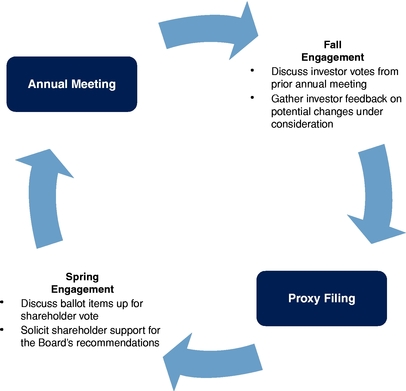

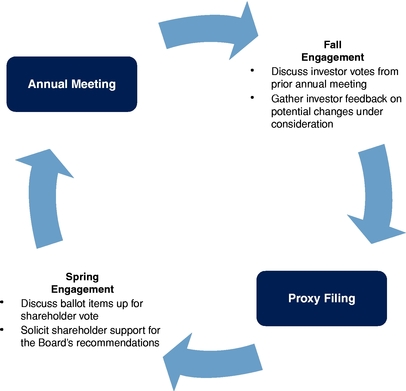

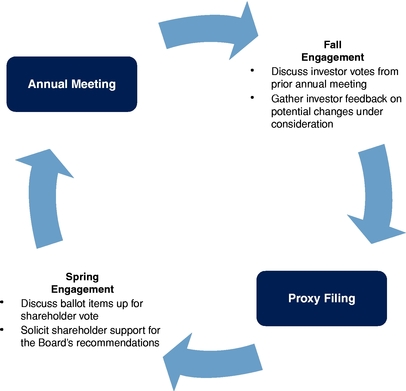

We believe that building positive relationships with our shareholders is critical to CF Industries'Industries’ success. We valueconduct shareholder outreach campaigns in the views of,spring and regularly communicatein the fall to engage with our shareholders to understand their perspectives on a variety of topics, such as our financial performance, corporateenvironmental, social, and governance initiatives, executive compensation, human capital management, environmental sustainability, community relations, and related matters. Management shares

We also communicate with shareholders through a number of routine forums, including

•

quarterly earnings releases;

•

Securities and Exchange Commission (“SEC”) filings;

•

the annual report and proxy statement;

•

the annual shareholders meeting;

•

investor meetings, conferences and web communications; and

•

sustainability reporting, including our ESG Report and our Sustainability Report.

We relay shareholder feedback

received from shareholders with the Board. Our chairman, our committee chairs, and

other members oftrends on corporate governance and sustainability developments to the Board

may also be available to participate in meetings with shareholders as appropriate. Requests for such a meeting are considered on a case-by-case basis.and its committees. Our engagement activities have resulted in valuable feedback that has contributed to our decision-making with respect to these matters.

We conduct shareholder outreach campaigns in the spring and in the fall. Our engagements in the spring are primarily focused on ballot items on which shareholders will vote at our annual meeting. Our engagements in the fall generally focus on voting outcomes from our prior annual meeting – including direct shareholder feedback on how they voted on ballot items – as well as potential corporate governance or executive compensation changes the Board and its committees are considering. The fall engagement also presents an opportunity to discuss with shareholders developments in their methodologies and analyses and potential future areas of focus.

In the first half of 2019 leading up to our 2019 annual meeting, we contacted shareholders comprising approximately 75% See “Corporate Governance — Shareholder Engagement” for a further discussion of our outstanding shares to invite them to speak with members of our senior management and the chair of our compensation and management development committee. Combined, management and our compensation and management development committee chair met with shareholders representing approximately 23% of our outstanding shares in advance of our 2019 annual meeting, discussing with these shareholders the ballot items on which shareholders would be voting at our 2019 annual meeting, in particular our 2018 executive compensation program and the say-on-pay vote, and other governance focused matters.

During the second half of 2019 following our 2019 annual meeting, we contacted shareholders comprising approximately 75% of our outstanding shares inviting them to speak with members of our senior management. Combined, management and our compensation and management development committee chair held meetings with shareholders accounting for 42% of our outstanding shares, discussing with these shareholders the voting outcome from our 2019 annual meeting as well as general governance, compensation, corporate responsibility and sustainability matters.

shareholder engagement activities.

Our executive compensation practices are overseen and administered by the compensation and management development committee, which is comprised exclusively of independent directors. The committee is responsible for designing an executive compensation program

–— including approving any changes to it

–— that effectively incentivizes our executives to create long-term value for our shareholders.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Summary | | | | More

Details | | |

| | | | | | Summary

|

| | | More Details |

| |

| | | | Compensation

Philosophy | | | | | | | | | | | | | |

| | |

| | | Our compensation philosophy seeks toalign the interests of our employees and our shareholders through focusing on the total compensation (base salary, short-term incentives, long-term incentives, and benefits) of our employees, including our executive officers. We seek to benefit from this strategy byattracting key talent, retaining strong performers, increasing productivity, and maximizing operational and financial results, while also implementing compensation programs that arecost effective, market competitive, and sustainable across business cycles. | | | | P. 54 | | |

| | | | | | | | P. 52 | | |

| | | Key Elements of

Compensation Program | | | | Salary | | |

| | Key Elements of

Compensation Program

|

| | | Salary | | Paid in line with individual performance and contribution to company goals and aligned to competitive market data | | | | P. 55,59 | | |

| | | | | | | | P. 53;57 | | |

| | Annual Cash

Incentives* | | | | | | | | | | |

| | | | | | Annual Cash Incentives | | The amount of the actual incentive earned is determined based on our level of achievement of twothree performance metrics: 75%80%: level of achievement ofAdjusted EBITDA* (Primary* (Financial Metric) 25%10%: level of achievement of the development of a list of capital projects to ammonia production goalsreduce the company’s Scope 1 GHG emissions footprint versus a 2019 baseline (Environmental Metric)

•

10%: level of achievement of the completion of safety critical equipment inspections on schedule and timely management of changes, subject to first achieving a gating level of performance onbehavioral safety practices goals

(Secondary(Process Safety Metric) | | | | P. 55, 59-65 | | |

| | | | | | | | P. 53; 56-62 | | |

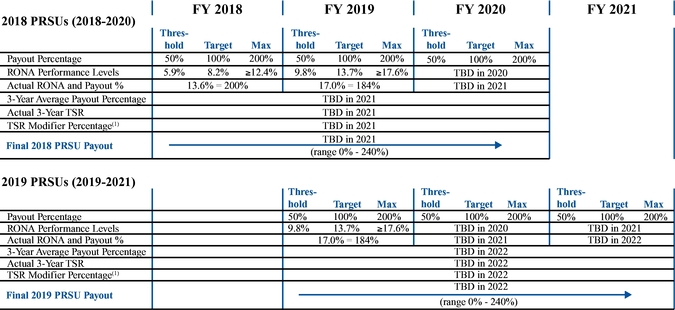

| | Long-Term Equity

Incentives | | | | | | |

| | | | | | Long-Term Equity Incentives | | A specified cash value amount is split amongbetween two different equity award types: 60%: PRSUsperformance restricted stock units (“PRSUs”) (3-year cliff vesting based on averagereturn on net assets (RONA)(“RONA”)** over three one-year periods, and a TSR modifier that can decrease or increase payout by up to 20%) 40%: RSUsrestricted stock units (“RSUs”) (3-year ratable vesting) | | | | P. 55, 65-69 | | |

| | | | | | | | P. 53; 63-69 | | |

| | | Rigorous Benchmarking and

Incentive Target Setting | | | | Bench-marking | | |

| | Rigorous Benchmarking and

Incentive Target Setting

|

| | | Bench-marking | | Our total direct compensation istargeted at the 50th percentile of our Industry Reference Group, which is comprised of 17 companies in related industries, and the overall general industry market data. | | | | P. 5755 | | |

| | | | | Incentive Metrics

and Performance

Levels | | | | | | | | | | | | |

| | | | | | Incentive Metrics and Performance Levels

| | •

We utilize performance metrics for our incentive compensation programs that that align executive interests with those of our shareholders. Executives are focused on achieving top performance across metrics that aredirectly tied to shareholder value creation and our core strategic objectives. The compensation and management development committee considersthe previous year'syear’s financial performance, market trends and the company'scompany’s annual business plan when setting goals and targets for our incentive compensation programsprograms. The performance metrics and target performance levels reflectthe inherent cyclicality of our business | | | | P. 55-58,.60-64,

66-71

| | |

| | | | | | | | P. 53-56; 57-62; 63-67 | | |

| | | Leading Compensation

Governance Practices | | | | | | | | |

| | Leading Compensation

Governance Practices

|

| | | Our leading compensation governance practices include: ✓

| | |

| | | | | Strong pay-for-performance alignment ✓

| | | | | | No employment agreements | | |

| | | | | Robust clawback policy covering incentive awards ✓

| | | | | | No repriced stock options | | |

| | | | | Stock ownership guidelines ✓

| | | | | | Minimal perquisites | | |

| | | | | Performance metrics that align executive interests with interests of shareholders ✓

| | | | | | Executive officers are prohibited from hedging or pledging our stock | | |

| | | | | A majority of compensation for CEO and other executive officers is performance-based, at risk, and paid in equity | |

✓

No employment agreements

✓

No repriced stock options

✓

Minimal perquisites

✓

Executive officers are prohibited from hedging or pledging our stock

✓

| | | | No new excise tax gross-ups after 2011 (CEO, CFOchief financial officer and SVP-HRsenior vice president, human resources have no such gross-up) | | |

| | | | | | | | | | | | | | | | |

See “Compensation Discussion and Analysis — Compensation Discussion and Analysis: In Detail — 2022 Compensation Actions” for a discussion of changes to our performance metrics and weightings for 2022.

**

For the definitions of Adjusted EBITDA and RONA, see "Compensation“Compensation Discussion and Analysis –— Compensation Discussion and Analysis: In Detail –— Key Elements of NEO Compensation Program –— Our Metrics Defined."”

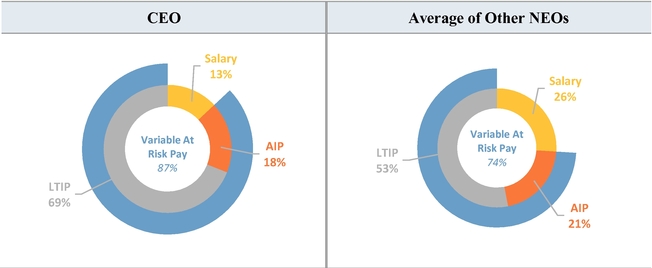

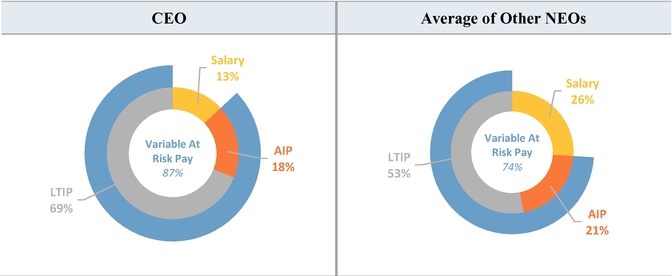

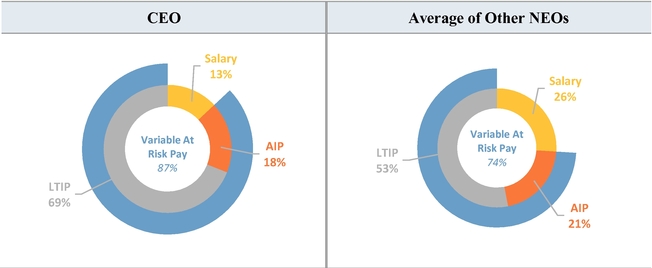

The compensation and management development committee believes the majority of compensation should be composed of awards that are performance-based

–— with direct ties to the

Companycompany and individual employee performance. The significant majority of the target compensation of each named executive officer

("NEO"(“NEO”) is at-risk based on company performance.

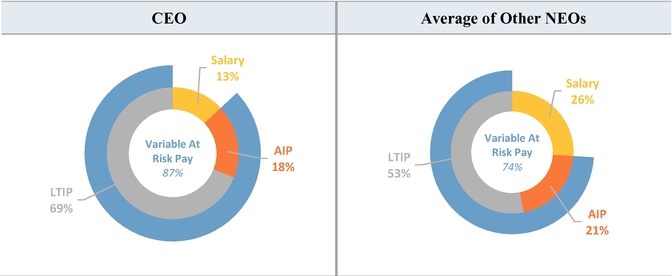

The following graphs illustrate the mix of total target direct compensation for our chief executive officer and for our other named executive officers for

2019:2021:

AIP:

Annual Incentive Plan (annual bonus), cash settled

LTIP:

Long-Term Incentive Plan, denominated in equity

Changes to AIP Performance Metrics and Weightings for 2022

The compensation and management development committee approved changes in the performance metrics and metrics for our annual incentive program for 2022. The annual incentive awards to our NEOs for 2022 will be determined based upon our level of achievement of the following performance metrics:

•

Table80% of Contentseach executive’s annual incentive payment opportunity is based upon our level of achievement of Adjusted EBITDA for 2022 (the “Adjusted EBITDA Metric”);

•

10% of each executive’s annual incentive payment opportunity is based upon our level of achievement of the completion of specified “Program Simplification” milestones (the “Strategic Initiative Metric”) related to an enterprise-wide project to increase automation and better integrate our processes, technology and reporting systems to strengthen and expand our capabilities for our long-term growth and sustainability; and

•

10% of each executive’s annual incentive payment opportunity is based upon our level of achievement of the completion of safety critical equipment inspections on schedule and timely management of changes, subject to first achieving a gating level of behavioral safety practices goals (the “Process Safety Metric”).

Our Adjusted EBITDA Metric, which has been a part of our annual incentive performance metrics since 2016, increased in weighting from 75% (in 2018, 2019 and 2020) to 80% in 2021 and will remain at 80% for 2022. The new Strategic Initiative Metric reflects the importance of an enterprise-wide strategic project to increase automation and better integrate our processes, technology and reporting systems to strengthen and expand our capabilities for our long-term growth and sustainability, and the extensive resources and employee effort that will be focused on the implementation. The Process Safety Metric, which was added to our annual incentive performance metrics in 2021 and maintains a behavioral safety practice goal that was since 2018 also part of our annual incentive performance metrics as a gating standard (“safety gate”), reflects our focus on safely operating our facilities in a way that benefits a broad set of stakeholders: employees, shareholders, customers and the communities in which we operate. The inclusion of

the Strategic Initiative Metric and the Process Safety Metric with the safety gate component in our performance metrics for the annual incentive payment opportunity demonstrates our commitment to our “Do It Right” culture and further integrates strategic corporate goals into executive compensation. The performance levels and corresponding percentages of target opportunity earned with respect to the 2022 performance metrics established by the compensation and management development committee will be disclosed in the proxy statement for our 2023 annual meeting of shareholders.

For a further discussion of 2022 AIP performance metrics and weightings for 2022, see “Compensation Discussion and Analysis — Compensation Discussion and Analysis: In Detail — 2022 Compensation Actions.”

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTOR NOMINEES

Our directors are elected each year for one-year terms expiring at the next annual meeting of shareholders.

The Board has nominated the eleven

directorsindividuals named in this Proxy Statement for

re-electionelection at the

2020 Annual Meeting.

John D. JohnsonAll of the director nominees are present directors of the company standing for re-election. Stephen A. Furbacher will retire from the Board effective as of the date of the

2020 Annual Meeting and will not stand for re-election. Each director elected at the

2020 Annual Meeting will serve

a one-year termuntil our next annual meeting and until his or her successor is duly elected and

qualified.qualified, or until his or her earlier death, resignation or retirement.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. If any nominee becomes unavailable to serve, an event that the Board does not presently expect, we will vote the shares represented by proxies for the election of directors for the election of such other person as the Board may recommend. Unless otherwise instructed, werecommend, unless the Board decides to reduce its total size.

If all eleven director nominees are elected, the Board will

vote all proxies we receive FORconsist of eleven directors, each of whom other than our CEO will be “independent” under the

directors listed below.listing standards of the New York Stock Exchange (the “NYSE”).

Majority Vote Standard for Election of Directors

Our directors are elected by a majority of the votes cast in uncontested elections,

(thewhich means that, for a director nominee to be elected in an uncontested election, the number of shares voted

"for" a“for” that director nominee must exceed the number of votes cast

"against"“against” that director

nominee). An "uncontested election of directors" means an election of directors in which, as of the date that is fourteen days in advance of the date we file our definitive proxy statement with the Securities and Exchange Commission ("SEC"), the number of nominees for election does not exceed the number of directors to be elected by the shareholders at that election.nominee. In a contested election,

(a situation where the number of nominees for election exceeds the number of directors

to be elected), the standard for election would beare elected by receiving a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors.

A contested election is a situation in which the number of nominees for election exceeds the number of directors to be elected. Whether an election is contested is determined fourteen days in advance of the date we file our definitive proxy statement with the SEC.

Director Resignation Policy

In accordance with procedures set forth in the

company'scompany’s corporate governance guidelines, any incumbent director (including the

eleven11 nominees standing for

electionre-election at the Annual Meeting) who fails to receive a majority of votes cast in an uncontested election will be required to tender his or her resignation for consideration by the

company'scompany’s corporate governance and nominating committee. The corporate governance and nominating committee will consider the resignation and, within 45 days following the date of the applicable annual meeting, make a recommendation to the Board concerning the acceptance or rejection of the resignation. The Board will then take formal action on the corporate governance and nominating

committee'scommittee’s recommendation no later than 90 days following the date of the annual meeting. Following the

Board'sBoard’s decision on the

committee'scommittee’s recommendation, we will publicly disclose the

Board'sBoard’s decision, together with an explanation of the process by which the decision was made and, if applicable, the

Board'sBoard’s reason or reasons for rejecting the tendered resignation.

DIRECTOR SUCCESSION PLANNING AND NOMINATION PROCESS

The Board is responsible for nominating memberscandidates for election to the Board and for filling vacancies on the Board that may occur between annual meetings of shareholders. The corporate governance and nominating committee is responsible for identifying, screening, and recommending candidates to the Board for Board membership.

Table of Contents

Regular Assessment of our Board Composition and Succession Planning

The chairman of the boardBoard and chair of the corporate governance and nominating committee lead an active process to regularly review the overall composition of the Board and each Board committee

and assess whether each reflects the appropriate mix of experience, qualifications, attributes, and skills that are relevant to CF

Industries'Industries’ current and future global strategy, business, and governance. Board composition and succession planning is a standing item on the calendar for corporate governance and nominating committee meetings each year. The review process incorporates the results of the annual Board and committee performance and skills self-assessment processes described

underin “Corporate Governance — Leadership of the

heading "Corporate GovernanceBoard — Annual Board and Committee Self-Evaluations and Director Peer

Evaluations"Evaluations” in assessing and determining whether any gaps in experience, qualifications, attributes, and skills exist and the characteristics and critical skills required of prospective candidates for election to the Board.

In order to